About Asset Management

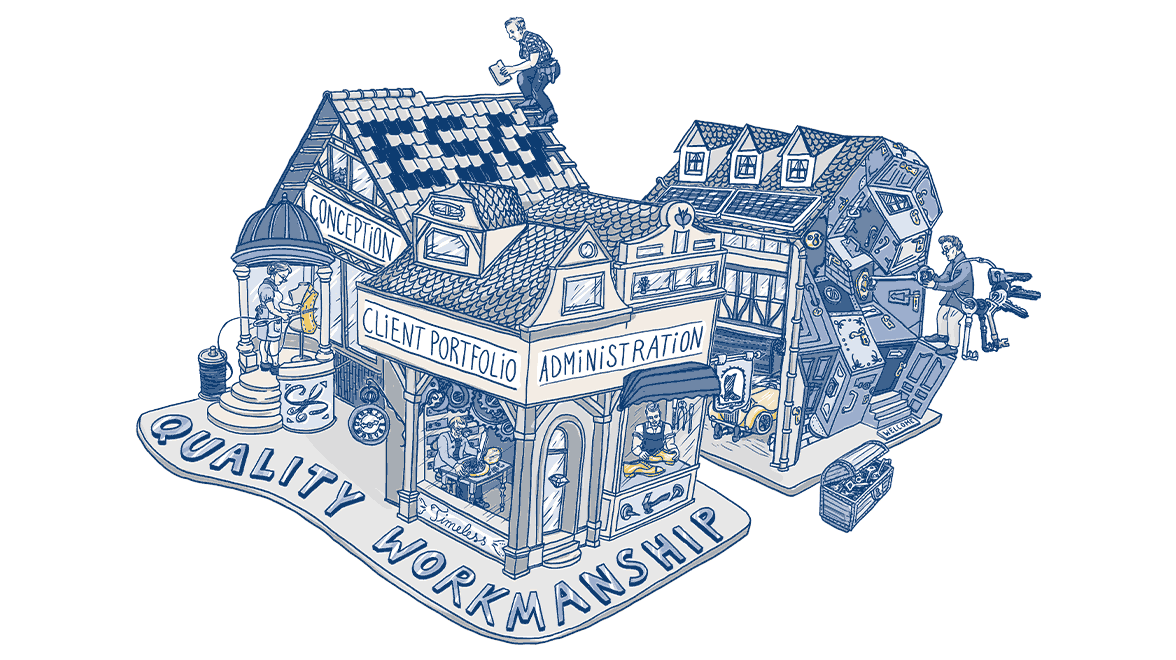

In our Asset Management division we provide investment services for institutional clients. We develop customized concepts for portfolio management in combination with efficient and secure solutions in the administration of asset management.

We talk in detail with each institutional investor about his or her specific objectives and risks. Through a shared set of values, mandates can evolve into long-lasting business relationships. We aim to offer our clients a balanced mix of standardized processes and individual services at all times, thus creating sustainable value.

Responsible member of the Executive Board

Franz von Metzler

Franz von Metzler, CESGA, joined Metzler in 2014. In 2023, he became a Member of the Executive Board of B. Metzler seel. Sohn & Co. AG and assumed responsibility for the Asset Management division and Human Resources. Furthermore, Mr. von Metzler is Member of the Board of Directors of the group companies Metzler Realty Advisors in Seattle, USA, Metzler/Payden, LLC in Los Angeles, USA, a joint venture with the US investment company Payden & Rygel, and Metzler Asset Management (Japan) Ltd. in Tokio. He also is Chairman of the Supervisory Board of Metzler Asset Management GmbH, as well as Deputy Chairman of the Supervisory Boards of Metzler Sozialpartner Pensionsfonds AG and of Metzler Pensionsfonds AG.

Thinking not just of today, but also of future generations.

Members of the Management Board

Timeline of Metzler Asset Management

Metzler Asset Management is part of the group that belongs to Metzler Bank, Germany's oldest private bank in unbroken family ownership since 1674.

2023

Franz von Metzler is joining the bank's Executive Board after five years without a member of the Metzler family serving on the board.

2021

With the sale of Metzler Ireland Limited, Metzler is consistently pursuing a shift in the strategic alignment of its asset management activities in order to focus on targeted expansion of client-oriented services such as portfolio management, pension management, sustainability investments and Master KVG.

2019

Metzler Asset Management founds the Sustainable Investment Office and recruits ESG experts

2018

Metzler Pension Management GmbH is founded.

2017

ESG reporting is introduced.

2016

Metzler Asset Management GmbH and Metzler Investment GmbH merge to form Metzler Asset Management GmbH.

2015

The first mutual fund with ESG integration is launched: the Metzler European Dividend Sustainability fund.

2012

Metzler Asset Management GmbH signs the UN Principles for Responsible Investment (PRI).

2009

Metzler opens a representative office in Beijing, China.

2006

The newly founded Metzler Real Estate GmbH advises and accompanies private and institutional clients in their real estate investments at home and abroad.

2002

- Metzlers Master-KVG offers controlling for institutional clients.

- The new business segment Metzler Pension Management develops individual solutions along the entire value chain of corporate pension schemes with a focus on advisory services.

2001

With Metzler Asset Management (Japan) Ltd., Metzler is now represented in Tokyo, one of the world's largest financial centers.

2000

Absolute return, capital preservation and benchmark-free strategies complement the product range.

1999

- Fixed income products are introduced.

- The newly established Applied Research team supports portfolio management in data analysis as well as product and systems development.

- Metzler receives its first ESG mandate.

- Cooperation begins with the sustainability rating agency oekom research (now: ISS ESG).

1998

Metzler enters into a cooperation with US asset manager Payden & Rygel.

1995

Metzler Asset Management GmbH is founded.

1994

Metzler puts its fund business on international footing by establishing the Irish fund management company Metzler Ireland Limited.

1987

Metzler's fund business is concentrated in Metzler Investment GmbH.

1971

Metzler launches its first mutual fund.

Deutsch

Deutsch English

English